Estate and Tax Tips

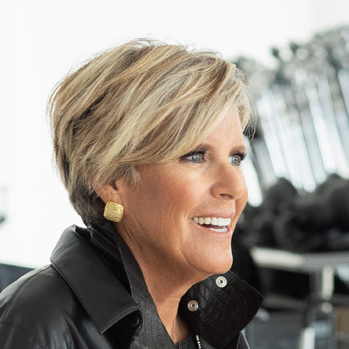

Suze Orman's Estate Planning Tips

“A big part of financial freedom is having your heart and mind free from worry about the what-ifs of life.” Ensure your assets pass to your loved ones and the causes you care about.

Ten Tips for an Executor

Serving as the executor of a family member’s estate has its challenges. By Liza Connelly, Fiduciary Advisor at CIBC Private Wealth

Brigham and Women’s Hospital Estate Planning Checklist

How do I start an estate plan?

Use this checklist to help you get organized:

- Make a list of everything you own—such as real estate, bank and investment accounts, personal collections, jewelry, cars, and boats.

- Decide who will receive things on that list—your family members, other loved ones, and the causes important to you.

- If you have minor children, choose a qualified guardian to look after them and name that person in your will.

- Depending on whether you have a will or trust, choose your executor or successor trustee. This person will be responsible for seeing that the terms of your will or living trust are carried out as you intended.

- Execute a power of attorney to name the person who will make financial decisions as well as a healthcare proxy for healthcare decisions.

- Importantly, consult an attorney specialized in estate planning who will create or advise you in drafting a will or living trust, as well as any other necessary documents pertaining to your estate.

This information is not intended as legal, accounting, or other professional advice. For assistance in charitable planning, consult an attorney for legal advice or obtain the counsel and services of another qualified professional.